Refinance Online Today! Find Out How Much You Can Afford. This includes any interest you pay on a loan secured by.

The mortgage interest deduction is a key tax provision that allows millions of homeowners to offset the mortgage interest paid each year against taxable income. You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate (MCC) by a state or local government. If you take this credit, you must reduce your mortgage interest deduction by the amount of the credit.

Mortgage interest is one of many itemized deductions. For every $1of income over $168you lose $of itemized deduction X 33. A mortgage interest deduction example. Is mortgage interest deductible on your taxes? Can you deduct mortgage interest on your taxes?

How do you write off mortgage interest? What qualifies for a mortgage interest deduction? If a mortgage does not meet these criteria, your interest deduction may be limited.

You can deduct home mortgage interest on the first $750($370if married filing separately) of indebt-edness. Home mortgage interest. We don’t make $500k a year, but we are subject to the AMT and also the reduced mortgage interest deduction thanks to the Pease phase - out rules. Payments, Get Quotes - Start Today! So there are real people out there that it does hit.

We are lucky to have such a problem, but it stills feels like we pay A LOT in taxes each year! The Internal Revenue Service allows you to deduct interest paid on your mortgage from your taxes as long as you itemize. For some, the deduction can make owning a home more affordable than renting. The itemized deduction phase - out affects the mortgage interest deduction , charitable contributions deduction , state income tax deduction and property tax deduction. Itemized Deduction Limits.

You use the house to secure the loan. The same year, you take out a $100loan to fix up your summer cabin, valued at $15000. The combined total for your loans is less than the $750limit. The tax deduction for student loan interest can be tricky to calculate. All deductions for expenses incurred in carrying out wagering transactions, and not just gambling losses, are limited to the extent of.

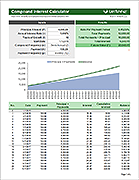

Finance costs includes mortgage interest , interest on loans to buy furnishings and fees incurred when taking out or repaying mortgages or loans. No relief is available for capital repayments of a. Buying a home can save you 10s of thousands of dollars in tax payments. Current mortgage rates are shown beneath the calculator. Use this calculator to find out how much your deductions are.

For more on mortgage interest under the new law,. MAGI of $80or more. Since some property tax payments and mortgage interest exceed the regular deductions that can be claime a number of homeowners have to itemize their deductions. Student Loan Interest Deduction Calculator.

Could a bigger refund be in your future? We’ll help you figure out if this deduction is right for you and how much it’s worth. What the new tax law will do to your mortgage interest deduction. New limits on home mortgage interest deductions.

North Carolina itemized deductions are not identical to federal itemized deductions and are subject to certain limitations.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.