Federal Tax Calendar - When Are Taxes Due? What is IRS payment plan? Pay with your bank account for free, or choose an approved payment processor to pay by credit or debit card for a fee. View your account information, such as the amount you owe and payment history, securely online. This form is due the last day of the first calendar month after the calendar year ends.

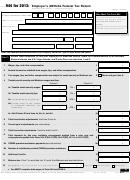

Certain small employers use it instead of Form 9to report social security and Medicare taxes and withheld income tax. Typically, of taxpayers get. Department of the Treasury.

Because of the coronavirus, anyone who owes $million or less in federal taxes is eligible for the penalty-free late payment. In addition, taxpayers will have until July. End Your IRS Tax Problems.

Stop Wage Garnishments. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Maximum Refund Guaranteed. The bracket depends on taxable income and filing status.

Taxpayers may also pay their tax with a personal check, money order or cashier’s check. Free for Simple Tax Returns. Similar penalties apply for missing other deadlines. This relief applies to all individual returns, trusts, and corporations.

Due dates for state payments may or may not coincide with the federal dates , so. Know the correct due dates if you are a semiweekly depositor to avoid late payments. The IRS tax refund schedule date is usually within days after efiling. This means that you can generally expect your funds to arrive in about a week and a half after your tax return has been filed. Estimated tax payment usually due on April 1 is now due on July 15.

Session is no longer active. Click here to begin a new session. Remember that the IRS only covers federal taxes. You will also have to file QET payments with your state. In the most ideal situation, you have a pass-through business and live in a state without income taxes , eliminating the need to file.

At first, the deadline for filing your taxes was Wednesday, April 15. This due date applies only if you timely requested an automatic 6-month extension. Otherwise, see March 15.

Get a Jumpstart On Your Taxes! A free way for the public, businesses, and federal agencies to pay their taxes online. Quick, secure, and accurate payments. Available hours a day, days a week.

We will update the filing due dates in the Tax Calendar as soon as possible. If you can’t meet the tax filing deadline, you can file for an extension. But the sooner you file, the sooner you can receive your tax refund. Different due dates apply to individuals and corporations, and certain individuals have due dates that do not pertain to others.

Income in America is taxed by the federal government, most state governments and many local governments. The federal income tax system is progressive, so the rate of taxation increases as income increases. Marginal tax rates range from to.

Visit us to learn about your tax responsibilities, check your refund status, and use our online services—anywhere, any time!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.