Payments, Get Quotes - Start Today! Find Out How Much You Can Afford. At most you'd get $off your tax for each $1of mortgage interest paid. Since if you didn't itemize you'd get a standard deduction, the actual effect is very likely less than that.

You could figure your taxes both ways and see what the. Mortgage interest for the first mos. The interest for the last mos. You would also report your rental income and any expenses you.

Schedule E for rental activities. If you are renting out the home (or a self contained living unit within the home) it may not be considered a qualified home for the purpose of taking the home mortgage deduction. See the qualified home section here:. What is the maximum mortgage interest that you can deduct?

How to calculate mortgage including the taxes? Is it possible to deduct mortgage interest? That’s the same amount the taxpayer would receive from taking the standard deduction.

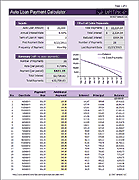

The “benefit” of the mortgage interest deduction is shown on the table below. Other articles from investopedia. Original or expected balance for your mortgage. Taxpayers can deduct the interest paid on first and second mortgages up to $000in mortgage debt (the limit is $500if married and filing separately).

Any interest paid on first or second mortgages over this amount is not tax deductible. Divide the maximum debt limit by your mortgage balance, then multiply the result by the interest paid to figure your deduction. Subtract the amount of interest you paid from the full monthly payment amount to calculate how much you paid in principal in the first month of the first year of the mortgage : $449. The mortgage interest deduction is used to deduct the interest paid on a home loan in a given year. When borrowers use the excess amount to buy, buil or substantially improve a principal residence or a second home, their interest payments come under the.

Home mortgage interest. You can deduct home mortgage interest on the first $750($370if married filing separately) of indebt-edness. Deductible mortgage interest is any interest you pay on a loan secured by a main home or second home that was used to buy, buil or substantially improve your home.

More Veterans Than Ever are Buying with $Down. Estimate Your Monthly Payment Today. Add the totals in interest , late fees and points to estimate your deductible mortgage costs. Taxpayers who have a mortgage may be eligible to claim a mortgage interest tax deduction.

Most homeowners can deduct all their mortgage interest. However, if your mortgage debt is above a certain amount, the deductible interest is proportional to the amount of your mortgage that falls within the threshold. Includes mortgage interest deductions , closing cost deductions , insurance deductions , and more. So, let’s say that you paid $10in mortgage interest. And let’s say you also paid $0in mortgage insurance premiums.

Your total deductible mortgage interest is $10on your next tax return. That assumes the private mortgage insurance deduction continues to be extended. Then, subtract the principal amount from that number to get your mortgage interest.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.